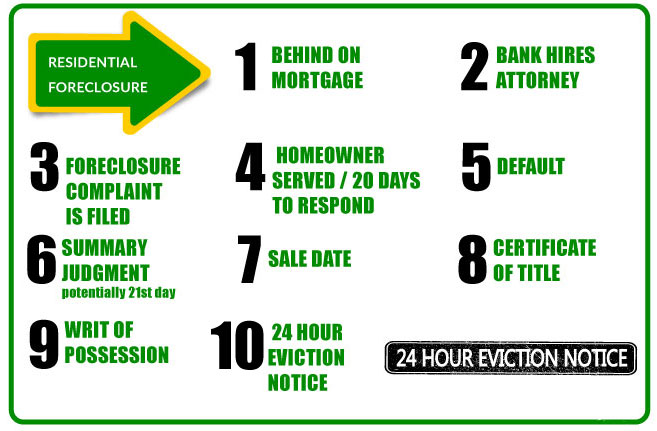

RESIDENTIAL MORTGAGE FORECLOSURE DEFENSE

1. BEHIND ON YOUR MORTGAGE

Most homeowners have fallen behind on their mortgage payments. Whether it's due to medical bills, loss of income, or death of a spouse, we understand. We have been through it ourselves. The phone calls, threatening letters, and unannounced representatives from your lender can be unbearable and intrusive.

YOU ARE NOT ALONE.

GIVE US AN OPPORTUNITY TO HELP YOU.

THE FORECLOSURE CAN BE REVERSED.

All too often we have seen homeowner’s rights trampled when there is not a proper defense presented. Homeowners who’ve had the money to save their home were evicted. Homeowners who’ve made payments on loan modifications have been forcibly removed by the sheriff when financial entities and their lawyers are concerned only about their bottom line and not the law.

Financial institutions and their lawyers use the court system as a sword. You need a sword and a shield. That is why a mortgage foreclosure defense lawyer is necessary. We can help whether it is before the foreclosure action is filed, after it is filed, and even after final judgement.

2. 90 DAYS: BANK HIRES AN ATTORNEY

If a homeowner is behind one mortgage payment, you may receive a default / acceleration letter from your lender. The default notice will provide 30 days to reinstate the past due payment(s). After 90 days of non-payment, the bank may hire an attorney to begin the foreclosure. In most cases, the homeowner knows nothing of the law suit until receiving solicitation letters from foreclosure defense attorneys.

3. FORECLOSURE COMPLAINT IS FILED

A homeowner will be shocked to learn there is no meaningful communication between your lender and their attorney when the complaint is filed. It is industry standard that no consultation, no meeting, and no conference call will occur between any human beings. Your bank’s computer “communicates” with the law firm’s computer and a complaint is electronically filed with the clerk's office in the county where the property is located.

The lack of interpersonal communication answers your question as to why the complaint does not contain your payment history, the reason why you fell behind, the e-mails, phone calls, as well as the visits to the bank you made to stop this. But there is another reason why the complaint contains no information. The complaint is designed to accelerate the taking of your home and minimize your ability to defend yourself.

YOUR LENDER AND THEIR LAWYERS DO NOT WANT TO REINSTATE YOUR LOAN. THEY ARE MAKING TOO MUCH MONEY.

4. HOMEOWNER SERVED 20 DAYS TO RESPOND

After the complaint is electronically filed with the clerk of court, your lender will attempt to “serve” you with the foreclosure law suit. Service simply means that a copy of the complaint must be served by: (1) Individual service. Individual service occurs when the lawyer’s process server hands you the complaint at your home or work. (2) Substitution service. Substitution service occurs when a process server hands the complaint to a relative living in your home. (3) Service by publication. Service by publication occurs when the lawyer notifies the homeowner by publishing the foreclosure complaint in a local newspaper where the foreclosed property is located. It is primarily utilized when an individual homeowner does not live in the foreclosed property. This is common for investment owners who receive rent, snowbirds, or relatives living in the family home.

QUASHING SERVICE

Service by substitution and publication can be challenged by examining the “affidavit of service” generated by the bank’s process server. We have seen countless examples in which an individual “accepted” service without authority on behalf of the homeowner. It is common for Plaintiffs' firms to use service by substitution or publication, by avoiding individual service, without exercising “due diligence”. When this occurs, we can quash service and stop the foreclosure from moving forward.

LEAVING THE COMPLAINT AT YOUR FRONT DOOR IS NOT SERVICE. THIS IS ANOTHER EXAMPLE OF THE BANK'S GREED VIOLATING YOUR RIGHTS AS A HOMEOWNER.

5. DEFAULT

YOU NO LONGER CAN DEFEND YOUR HOME.

ONCE THE HOMEOWNER IS “SERVED”, A “RESPONSIVE PLEADING” MUST BE FILED WITH THE CLERK OF COURT AND THE LENDER’S ATTORNEY WITHIN TWENTY (20) DAYS OF SERVICE. FAILURE OF A HOMEOWNER TO FILE A RESPONSIVE PLEADING WITHIN 20 DAYS FROM SERVICE MAY RESULT IN A DEFAULT.

QUITE OFTEN THE BANK’S LAWYERS WILL SERVE BY PUBLICATION TO EXPEDITE A DEFAULT. DEFAULTS ARE OFTEN OBTAINED THROUGH IMPROPER SERVICE.

DO NOT LET A DEFAULT BE ISSUED AGAINST YOU. WHEN A DEFAULT IS ENTERED, YOU HAVE ADMITTED TO:

Signing the note and mortgage.

Failing to pay the mortgage.

Receiving timely notice of the failure to pay.

Standing to file the law suit.

Judgement.

UPON DEFAULT, YOU CANNOT FILE:

Responsive pleading(s).

Motions to dismiss.

Affirmative defenses.

IF A DEFAULT IS ENTERED AGAINST YOU, THE ONLY ISSUE THAT CAN BE RAISED IS THE AMOUNT OWED.

UPON A DEFAULT, THE BANK’S ATTORNEYS ARE NOT REQUIRED TO PROVIDE YOU WITH HEARINGS, PLEADINGS, FILINGS, AND MOTIONS.

MOST IMPORTANTLY, YOU MAY NOT RECEIVE THE NOTICE OF HEARING AND MOTION FOR DEFAULT FINAL JUDGEMENT.

THE DEFAULT RESULTS IN A FINAL JUDGEMENT WITHOUT PRIOR NOTICE, AND A SALE OF YOUR PROPERTY WITH LESS THAN 30 DAYS FOR YOU TO TAKE ACTION.

WE CAN PREVENT A DEFAULT. WE KNOW WHAT TO DO. DEPENDING ON YOUR SITUATION, WE SHALL FILE:

A motion for extension of time to respond to the complaint.

A motion to abate proceedings.

A motion to dismiss the complaint.

An answer and affirmative defenses.

EVEN IF A DEFAULT HAS BEEN ENTERED WE CAN STILL HELP.

WE CAN FILE A MOTION TO VACATE THE DEFAULT AND/OR A MOTION TO QUASH SERVICE.

6. SUMMARY JUDGEMENT

In almost every case, the bank files a motion for summary judgement. A summary judgement motion is an invaluable weapon for your lender to obtain a sale date saving time and money by avoiding the need for a trial. At a summary judgement hearing, witness testimony is not allowed. Evidence can only be presented through the pleadings that have been timely filed. The bank’s attorney, based solely on the documents filed, will argue before the Court that there are no questions of fact and law.

DEPENDING ON THE ALLEGATIONS IN THE COMPLAINT, AND WITHOUT A HEARING,

SUMMARY JUDGEMENT MAY BE REQUESTED 21 DAYS AFTER SERVICE.

DEFENDING AGAINST SUMMARY JUDGEMENT

The most effective tool in preventing summary judgement is an affidavit in opposition to the motion. The affidavit creates a question of fact that prevents summary judgement and a sale of your home. We will review the documents with you, and prepare the affidavit in opposition to the motion.

Another effective tool in preventing summary judgement is an answer and affirmative defenses to the complaint. When filed, the answer creates issues of law preventing summary judgement.

WHETHER AT A SUMMARY JUDGEMENT HEARING OR TRIAL, MIDLER & KRAMER WILL NOT RELY ON THE DOCUMENTS PROVIDED BY THE LENDER. WE CHALLENGE THEM. EVERY DOCUMENT RECEIVED SHALL BE SCRUTINIZED AND QUESTIONED THROUGH DISCOVERY AND DEPOSITIONS.

Does the Plaintiff named in the complaint have the right to sue you?

Did the Plaintiff comply with the terms and conditions of your mortgage?

Who is the individual swearing to your complaint?

Does this individual have knowledge of your complaint?

How does this individual know your payment history?

Is this individual truly a corporate officer?

Does this individual have the authority to sign?

WE NEED TO UNCOVER THE WHO WHAT AND WHERE AS TO THE:

Note

Mortgage

Assignment

Payment history and

Notice of acceleration

When pressed, the financial institutions responsible for maintaining the documents and the individuals who are responsible for your loan often cannot answer these questions. This can lead to a potential victory at summary judgement, trial, and favorable negotiations. What are favorable negotiations will be determined by your goals. CLICK HERE

7. SALE DATE

If a foreclosure judgement is entered, your property will be scheduled for sale. You should receive a notice of sale in the mail but so often we are told that does not happen. On the sale date, the property is auctioned and typically your lender is the winning bidder.

You can track the online auction of your property by going to:

MIAMI-DADE COUNTY: https://www.miamidade.realforeclose.com/index.cfm?zaction=USER&zmethod=CALENDAR

BROWARD COUNTY: https://www.broward.realforeclose.com/index.cfm?zaction=USER&zmethod=CALENDAR

PALM BEACH COUNTY: https://mypalmbeachclerk.clerkauction.com/

DEPENDING ON THE AMOUNT OF THE SALE, AND HOW MUCH YOU OWE, THERE MAY BE:

Deficiency judgement

You will be considered “upside down” if the property is sold for an amount less than the final judgement. Your lender has one year to seek the deficiency and may file a separate law suit demanding the difference between what you owe and the value of the property.

Surplus funds

We can file a motion for surplus funds if your property is sold for more than the judgement.

Third party purchaser

If the property is sold to a third party, they will have you removed as quickly as possible.

THE DAY AFTER THE SALE, THE CLERK OF COURT SHALL ISSUE A CERTIFICATE OF SALE AND AFTER 10 DAYS, IF NO OBJECTION IS FILED, TITLE TO YOUR PROPERTY WILL TRANSFER.

8. CERTIFICATE OF TITLE

Certificate of title is issued by the clerk of court 10 days from the certificate of sale which transfers ownership of your property to the winning bidder.

Once the certificate is issued, you are no longer the owner of the property. You do not own the appliances and may not remove them.

YOU STILL HAVE A RIGHT TO REMAIN IN THE PROPERTY!

9. WRIT OF POSSESSION

ONCE THE NEW OWNER OBTAINS THE CERTIFICATE OF TITLE, THEY SHALL FILE A MOTION FOR WRIT OF POSSESSION. A WRIT OF POSSESSION AUTHORIZES THE NEW OWNER TO PROCEED WITH AN EVICTION.

MIAMI, BROWARD, AND PALM BEACH CLERKS OF COURT MAY ISSUE THE WRIT OF POSSESSION WITHOUT A HEARING. YOU WILL NOT KNOW ABOUT THE WRIT OF POSSESSION UNTIL A "24 HOUR EVICTION NOTICE" IS POSTED ON YOUR DOOR.

WE CAN ENSURE THIS DOES NOT HAPPEN.

OUR REPRESENTATION COMPELS THE NEW OWNER TO GIVE YOU NOTICE PRIOR TO A 24 HOUR EVICTION.

THIS IS THE ONLY WAY YOU WILL KNOW ABOUT THE EVICTION BEFORE THE 24 HOUR NOTICE IS POSTED ON YOUR DOOR.

10. 24 HOUR EVICTION

ONCE THE CLERK OF COURT ISSUES THE WRIT OF POSSESSION, LAW ENFORCEMENT FROM BROWARD, MIAMI-DADE AND PALM BEACH COUNTIES WILL POST A 24-HOUR EVICTION NOTICE ON THE PROPERTY. YOU HAVE ONLY 24 HOURS TO MOVE. THE 24-HOUR NOTICE INCLUDES WEEKENDS AND HOLIDAYS.

THERE IS NOTHING YOU CAN DO TO DELAY OR STOP THE EVICTION UNLESS THE SHERIFF RECEIVES A JUDGE’S ORDER.

WE HAVE DONE IT.

WE CAN DO IT.

CALL US.

WE ARE AVAILABLE 24/7 TO FILE AN EMERGENCY MOTION TO STOP THE EVICTION.

WE WILL CONTACT A JUDGE ON WEEKENDS, HOLIDAYS, AT ANY TIME DAY OR NIGHT.

WE WILL IMMEDIATELY CONTACT THE NEW OWNER TO NEGOTIATE:

Extensions of time.

Lease agreements.

Short payoffs.

Cash for keys.

GOALS

STAY IN YOUR HOME!

If it is your intention to keep your home, we can negotiate a loan modification, short payoff, or reinstatement. We have successfully eradicated well over one million dollars in principal for our clients.

FOR MORE INFORMATION CONCERNING LOAN MODIFICATIONS, click here.

Short payoff

A short payoff is a settlement where a homeowner will pay a lump sum less than what is owed in exchange for a satisfaction of mortgage.

Reinstatement

Reinstatement occurs when a homeowner pays the arrears. Through negotiation, these amounts may be separated into installment payments.

LEAVE YOUR HOME BUT DO NOT WALK AWAY!

If you do not want to keep your home, “walking away” is not the answer. You can be responsible for a deficiency judgement in which you owe the difference between the value of the property and the judgement.

The judgement will stay on your credit preventing you from potentially obtaining a new mortgage, car loan, or credit card. A deed-in-lieu-of-foreclosure, short sale, or a consent judgement waiving deficiency are meaningful alternatives that would save your credit score and protect you from a deficiency judgement.

Deed-in-lieu-of-foreclosure

A deed-in-lieu-of-foreclosure transfers title of your property to the Plaintiff. A deed-in-lieu vacates any judgment and dismisses the foreclosure case. This is an option where there are no second mortgages or liens. If said liens do exist, they can be negotiated allowing a deed-in-lieu-of-foreclosure.

Short sale

A short sale is a sale of your home for less than what you owe on your mortgage. If your lender agrees to a short sale, your home will be sold paying off your mortgage at a reduced amount. A short sale is an alternative to a foreclosure.

Consent judgement waiving deficiency

Consent judgement waiving deficiency is an option wherein a final judgement would be entered. The property would be sold at auction, no monies would be owed, and the judgement would be considered satisfied by the taking of the property. Entering a consent judgement could have tax implications and a consultation with your accountant/tax preparer is recommended.

MORTGAGE FORECLOSURE DEFENSE IN FT. LAUDERDALE, BROWARD, MIAMI-DADE, PALM BEACH, AND THROUGHOUT THE STATE OF FLORIDA